No sooner had pandemic-induced disruptions begun to wane than generative AI debuted late last year and shook everything up once again. Those dual trends continued in April when a number of disruptive industries felt the benefit of both AI and the return to somewhat normal for the first time since the pandemic.

It’s clear that as we continue to return to normal post-pandemic, disruptive technologies will continue to transform the way we live, work, and interact with each other.

Updates on Specific Disruptive Industries

Automobile Innovation

In April, the Biden administration announced proposed regulations requiring a significant portion of new vehicles sold in the United States to be electric by 2032. The new regulations—one a tailpipe pollution limits for cars and the other rule aimed at heavy-duty vehicles—would mean 67% of new light-duty passenger vehicles, 46% of new medium-duty trucks, 50% of new buses, and 25% of new heavy trucks sold would be all-electric by 2032.

Although the Environmental Protection Agency (EPA) is not permitted by law to mandate that car manufacturers sell a specific number of electric vehicles (EVs), under the Clean Air Act the agency can limit the total pollution produced by all the vehicles each manufacturer sells. The regulations as proposed have been constructed to ensure that the companies can only be compliant with such a pollution cap by selling a certain percentage of zero-emissions EVs.1

Cybersecurity

The Cyberspace Administration of China (CAC) announced that generative AI services would need to undergo security reviews before they are permitted to operate in China. The CAC’s guidelines require AI content be accurately labelled, respect intellectual property, avoid discrimination, and not pose security risks. These regulations are expected to significantly impact how AI models are trained in China, with companies needing to prioritize security when developing AI. Additionally, the CAC’s emphasis on maintaining control over sensitive data highlights the importance of robust cybersecurity measures in protecting against cyberattacks and data breaches when developing AI.2

Cloud Computing

Amazon Web Services holds a sizeable lead in the global cloud infrastructure market, but it is adopting a different growth strategy from competitors. AWS is focused on becoming a “neutral platform” providing businesses access to generative AI products without tying them to a single model. AWS will sell access to language models on a new service called Bedrock, which will enable access to models by Anthropic, Stability AI and AI21 Labs, as well as Amazon’s own language model, Titan, which can be trained on a customer’s data and avoid mingling public and private data in model.3

E-Gaming

UK antitrust regulators blocked Microsoft’s $69 billion purchase of Activision Blizzard, one of the world’s largest video game developers, over concerns the deal would threaten competition in cloud gaming. Despite Microsoft’s proposed remedies to ensure continued competition, such as deals to allow Activision Blizzard games such as “Call of Duty” and “Overwatch” to appear on rival cloud gaming platforms, the UK Competition and Markets Authority still felt the deal would make Microsoft (which already holds a 60%-70% global market share in cloud gaming) too dominant in the space and lead to “reduced innovation and less choice for UK gamers over the years to come.”4

While Microsoft and Activision Blizzard plan to appeal the ruling, even if they are successful the deal isn’t out of the woods yet. Both the US Federal Trade Commission and the European Union are evaluating the proposed takeover based on similar competition concerns.5

Genomics

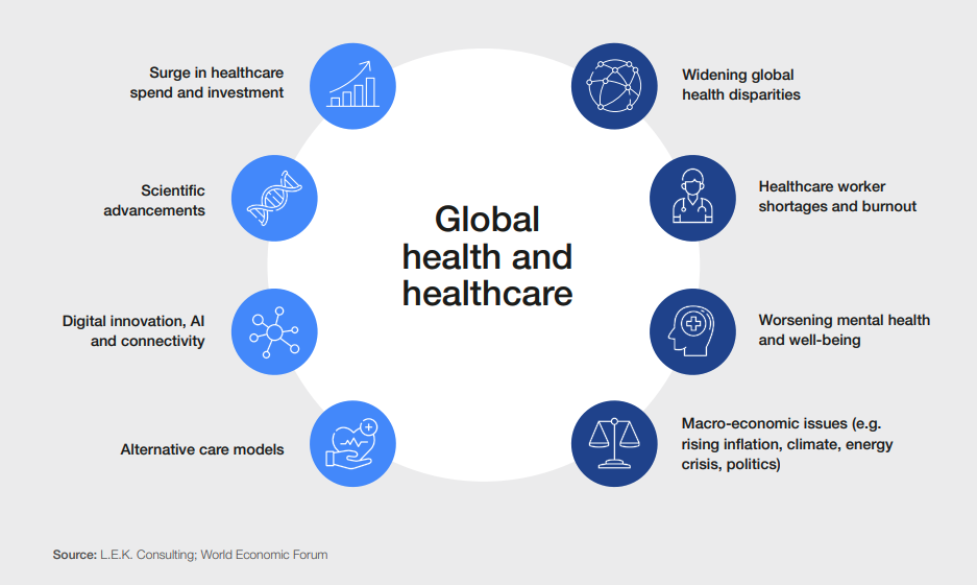

World Healthcare Day was on April 7th, and the World Economic Forum (WEF) highlighted eight trends shaping global healthcare today in the post-pandemic world.

Amongst them, the WEF noted that global healthcare spending grew more than 40% to $12 trillion between 2018 and 2022. Healthcare investments are also at all-time highs, with particular focus on gene immunotherapy and mRNA vaccines. The field has also benefitted from digital innovation and the use of big data and AI to aid in research and improved patient outcomes. Digital investment in the sector is now $57 billion, with growth seen particularly in telehealth and mental health. AI is being rolled out to assist in diagnosis, monitoring and treatment, improved medical imaging, and AI-assisted drug research and development.6

Fintech

Post-pandemic benefits are beginning to show themselves in the payments sector.

Visa Inc posted net income of $4.26 billion for their Q2, up from $3.65 billion a year earlier. Revenue was also up to $7.99 billion, beating projections of $7.80 billion and well ahead of the $7.19 billion from the same time last year.7 Likewise, MasterCard saw a 14% YoY increase in revenue for the quarter, coming in at $5.7 billion, just bettering analyst expectations of $5.6 billion.8

Both companies credited increased consumer spending, increased cross-border travel post-pandemic, as well as digital payment and value-added opportunities for their better-than-expected earnings. Mastercard said cross-border spending was up 35% over last year, while Visa saw a 24% increase in cross-border spending.9

Robotics & Automation

Intuitive Surgical Inc reported Q1 revenue of $1.7 billion, up 14% from last year and beating analyst estimates of $1.6 billion. The number of total procedures performed with Intuitive Surgical’s Da Vinci and other robotic surgical systems grew by 26% YoY in Q1, well above estimates of 15%.

The better-than-expected results were credited to a widespread return of patients to in-person healthcare since the pandemic, as well as an increase in the number of hospitals using robotic-assisted procedures for minimally invasive surgeries.10

5G

Three years after the successful launch of consumer-facing 5G services, SoftBank Corp announced the launch of its “Private 5G” service for enterprises in Japan. SoftBank’s Private 5G is a managed 5G service that offers customization options based on the needs of specific clients, including companies, local governments, and other kinds of organizations.

Using “network slicing,” the Private 5G service can divide up its licensed spectrum to provide 5G connectivity to hyper-specific locations, from an entire municipality down to a specific factory floor, allowing clients to benefit from a stable, secure, high-performance 5G network wherever they need one.11

EDGE ETF: Diversified Investing in Innovation

The Evolve Innovation Index Fund (EDGE ETF) is an 8-in-1 innovation fund that invests in disruptive innovation themes across a broad range of industries, including: cloud computing, cybersecurity, egaming & esports, automobile innovation, 5G, fintech, genomics, and robotics & automation. Give your portfolio an EDGE.

EDGE ETF Portfolio Strategy and Activity

For the month, Intuitive Surgical Inc made the largest contribution to the Fund, followed by BeiGene Ltd, and Fiserv Inc., and Evolve Cyber Security Index Fund. On last rebalance, this security was added to the portfolio: Hologic Inc (Genomics), SoftBank Corp (5G), AT&T Inc (5G), and Broadridge Financial Solutions Inc (FinTech).

For more information on EDGE ETF, visit our website at https://evolveetfs.com/edge/.

To stay updated with insights on investing and related investment products, sign up for our weekly newsletter here.

Sources:

- Davenport, C., “E.P.A. Lays Out Rules to Turbocharge Sales of Electric Cars and Trucks,” The New York Times, April 12, 2023; https://www.nytimes.com/2023/04/12/climate/biden-electric-cars-epa.html

- “China Mandates Security Reviews for AI Services Like ChatGPT,” Bloomberg, April 11, 2023; https://www.bloomberg.com/news/articles/2023-04-11/china-to-mandate-security-reviews-for-new-chatgpt-like-services

- Day, M., “Amazon Joins Generative AI Race, Targets Tech at Cloud Customers,” BNN Bloomberg, April 13, 2023; https://www.bnnbloomberg.ca/amazon-joins-generative-ai-race-targets-tech-at-cloud-customers-1.1907298

- Ziady, H., “UK blocks Microsoft takeover of Activision Blizzard,” CNN Business, April 26, 2023; https://www.cnn.com/2023/04/26/tech/microsoft-activision-blizzard/index.html

- Ibid

- Bishen, S., “World Health Day: 8 trends shaping global healthcare,” World Economic Forum, April 5, 2023; https://www.weforum.org/agenda/2023/04/world-health-day-healthcare-trends/

- Bary, E., “Visa earnings top expectations as payment volume rises 10% on travel rebound,” MarketWatch, April 26, 2023; https://www.marketwatch.com/story/visa-earnings-top-expectations-as-payment-volume-rises-10-aff5292c

- English, C., “Mastercard Beat Shows Households Are Spending More on Travel. The Stock Rises.,” April 27, 2023; https://www.barrons.com/articles/mastercard-earnings-stock-price-bb6e0c4b

- Ibid

- Ferré, I., “Intuitive Surgical stock up 12% amid rise in procedures, return of patients to docs,” Yahoo Finance, April 19, 2023; https://ca.finance.yahoo.com/news/intuitive-surgical-stock-up-12-amid-rise-in-procedures-return-of-patients-to-docs-171456225.html

- “SoftBank Corp. Launches Private 5G Service that’s Custom-built for Enterprises,” SoftBank Corp, April 18, 2023; https://www.softbank.jp/en/sbnews/entry/20230418_01