In recent years, cryptocurrencies such as bitcoin have received considerable coverage in the business news, with investors increasingly interested in the potential of this new asset class.

After its first boom in 2017, when prices spiked to US$20,000 per bitcoin before retreating, the cryptocurrency’s price has begun to climb again. So far, in 2021, the price of bitcoin has risen by 50 percent. And that’s on top of 300 percent gains over the course of 2020. In mid-February, the value of a single bitcoin ventured north of US$50,000 for the first time.

While many investors may have been put off by cryptocurrencies due to the foreignness of concepts like digital wallets and blockchains, with the debut of bitcoin-based ETFs, such as Evolve’s new EBIT bitcoin fund, it is more straightforward than ever for investors to add this attractive new asset class to their investment portfolios.

Why Bitcoin?

As a technology that’s only a decade old, blockchain—the distributed ledger technology that underlies bitcoin—has taken some time to grow accustomed to. However, over the last ten years, both governments and investors have begun to understand the revolutionary potential of cryptocurrencies, the best-known use case for blockchain.

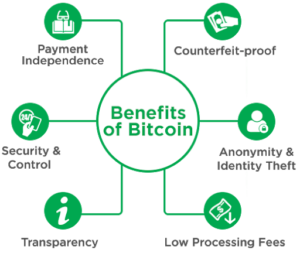

Bitcoin is a cost-effective, flexible alternative to traditional fiat currencies. For example, the bitcoin payor (the party sending funds) can set the transaction fee or eliminate it altogether. It is effectively a borderless currency that can be sent worldwide in an instant, with no delays or holding periods.

Both micro- and macro-payments are supported by bitcoin, meaning you can send both very small and very large payments through the bitcoin network and not have to pay transaction costs, which was not possible with traditional payment methods. This can be especially important when fees to send micro-payments through traditional means could easily cost more than the value of the payment itself.

Bitcoin is also incredibly secure. As a ‘push payment’ system (similar to a wire transfer), transactions are initiated by the payor, who specifies the payee and the exact amount. These transactions are final, with no internal dispute mechanism within the bitcoin protocol. Contrast this with traditional ‘pull payment’ methods with dispute mechanisms meant to protect consumers, but which are rife with fraud from bad actors.

The emergence of cryptocurrency markets and exchanges modelled on traditional investment exchanges has done much to bring cryptocurrencies into the mainstream. As investors gain a greater understanding of cryptocurrencies, the ranks of investors committed to crypto will undoubtedly continue to grow.

The Pros of Investing in Bitcoin

Source: harmonyatwork.org

There are dozens of cryptocurrencies other than bitcoin. Why does bitcoin stand out as a solid investment candidate? Here are five reasons to consider reducing your exposure to fiat currencies and invest in bitcoin.

- The authority and liquidity of Bitcoin

While there are other cryptocurrencies available, bitcoin was the first mover in the digital currency space. As such, it is the most popular cryptocurrency by a significant margin. Bitcoin has established itself as reliable, while newcomer currencies struggle to build trust. And as the most popular cryptocurrency, bitcoin enjoys greater liquidity than rival currencies, retaining most of its inherent value when converting to fiat currencies, such as the US dollar and euro. Few other cryptocurrencies can be directly exchanged for fiat currencies and those that can lose substantial value in such exchanges.

- Built-In Scarcity

Like the scarcity that imbues gold and other precious metals with intrinsic value, the built-in scarcity of Bitcoin—only 21 million bitcoins will ever exist—imbues the currency with an inherent value. Unlike traditional currencies (which can be created at will by central banks) and non-scarce cryptocurrencies, the scarcity of bitcoin should support its long-term value against these other assets.

- Easier International Transactions

Because bitcoin is an independent currency not reliant upon any one nation, bitcoin transactions made between countries are no different than bitcoin transactions that occur within a single country. Bitcoin transactions avoid the international transaction fees you will typically encounter with credit cards, ATM withdrawals, and international money transfers.

- Anonymity and Privacy

Bitcoin’s built-in privacy protections allow users to divorce their bitcoin accounts from their public personas if they wish to. Contrast this with traditional fiat currencies in an online bank account or online credit card and PayPal transactions, which can be tracked and analyzed by both private merchants and public authorities.

- Growing Acceptance as a Payment Method

As the idea of bitcoin has become more mainstream, the number and kinds of businesses accepting payment in bitcoin have grown. Thousands of merchants worldwide currently accept bitcoin payments, including Expedia, Microsoft, Overstock.com, and most recently, electric car manufacturer Tesla. As the popularity of cryptocurrencies continues to grow over time, expect that number to proliferate, both in online storefronts and physical retail locations, for all manner of goods and services.

The Industries Impacted by Bitcoin

And with its growing acceptance as a payment method and its origins as a better way to facilitate online payments, expect bitcoin to revolutionize the payments industry and how businesses send payments to vendors and receive payments from clients and customers.

This shift is already beginning to happen in the payments space, with Mastercard announcing they will start supporting select cryptocurrencies, including bitcoin, directly on their global payment network. This shift came after Mastercard noted the growing trend of people using their network to complete purchases of crypto assets and the rise of crypto cards (essentially crypto-linked debit cards) to access cryptocurrencies and convert them to fiat currencies.

Likewise, point-of-sale solutions and peer-to-peer payments company Square has, since 2018, allowed the buying and selling of bitcoin on its network. In 2019, the company formed Square Crypto, an independent team solely focused on contributing to bitcoin open-source work. Like Tesla’s recent investment in Bitcoin, in October 2020, Square purchased 4,709 bitcoins with an aggregate purchase price (at the time) of $50 million. In their announcement, Square professed their belief that cryptocurrency like bitcoin is “an instrument of economic empowerment and provides a way for the world to participate in a global monetary system.”

With the number of merchants accepting bitcoin as payment growing steadily, it’s clear that the blockchain technology that supports cryptocurrency is rapidly moving into the mainstream. Bitcoin payments solutions are a natural next step in electronic payment delivery, with both merchants and consumers benefitting from increased convenience and lower fees.

Investing in bitcoins with Bitcoin ETF

Get access to the price of bitcoin through an Exchange Traded Fund structure.

Bitcoin ETF offers:

- Daily liquidity

- Simple to trade

- No wallet required

- Trades with an exchange ticker

- Held in brokerage accounts

- RRSP & TSFA Eligible

Sign up for our newsletter to stay on top of bitcoin and other disruptive innovation trends.

The contents of this blog are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

These contents are not an offer or solicitation of an offer or a recommendation to buy or sell any securities or financial instrument, nor shall it be deemed to provide investment, tax or accounting advice. The information contained herein is intended for informational purposes only.

Commissions, management fees and expenses all may be associated with exchange traded funds (ETFs) and mutual funds (funds). Please read the prospectus before investing. ETFs and mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. There are risks involved with investing in ETFs and mutual funds. Please read the prospectus for a complete description of risks relevant to ETFs and mutual funds. Investors may incur customary brokerage commissions in buying or selling ETF and mutual fund units.

Certain statements contained in this blog may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Evolve Funds undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.