Executive Summary

Generative AI – the buzziest term of 2023, thanks mostly to the surge of interest created by the launch of ChatGPT – promises to change the landscape of work, allowing for more efficiency across a vast swath of industries. In the investment management field, the biggest productivity gains will be seen by adopting generative AI for simple tasks like news monitoring and more complex jobs like ensuring compliance with investment policies. Testing, and a buy-not-build approach will be critical for teams looking to see early adopter gains.

What is generative AI?

Generative AI is a form of artificial intelligence – made famous by OpenAI’s launch of ChatGPT in November 2022 – that can autonomously produce content. Since ChatGPT’s launch, a flurry of other tools have helped business professionals across fields like marketing, content creation, design, software development, healthcare, translation and finance. Generative AI not only accelerates the speed with which teams can get work done, it improves the output itself: in a paper by the Harvard Business School, its authors found that participants using generative AI produced “significantly higher quality results (more than 40% higher quality compared to a control group).”

We will use the terms generative AI and large language models (LLM) interchangeably here – but, similarly to the terms machine learning and artificial intelligence, LLM is a subset of generative AI. Large language models, as one might guess, focus on text specifically (we won’t delve into image processing in this guide, but generative AI is also producing exciting results in the world of art and design).

In essence, LLMs are trained on virtually all digitized human knowledge, to learn how words tend to interact with each other.

The importance of the impact of generative AI cannot be understated. A recent report by McKinsey estimates that generative AI could add the equivalent of $2.6 trillion to $4.4 trillion across the use cases they analyzed – for context, the United Kingdom’s entire GDP in 2021 was $3.1 trillion.

How does generative AI work?

As described above, LLMs train on huge amounts of text data (also called unstructured data). Every word, or sometimes sequences of words, is given a unique identifier for the LLM to learn how the words interact with each other. This is what is called a “base model” and is good for simple use cases like asking for all the recipes that include a specific set of ingredients, generating simple written content, or describing best practices within a specific field (i.e. “how should I prepare to study for my CFA II exam?”).

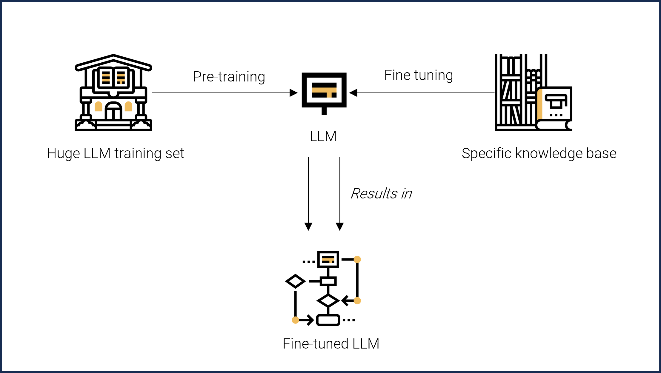

Many users of generative AI want more specifics, and they can get these by created “fine tuned” models. Here, the output of the LLM is improved by training it on specific knowledge bases. For specific domains, like finance, fine tuning is a difficult but vitally important part of the process.

The goal of any LLM is to be able to ask a question and get a good answer. Getting that good answer is where continual fine tuning becomes extremely important, because the goal is to have the LLM become a generator of consistently good answers.

What have been the early benefits of generative AI?

Artificial intelligence has real and powerful impacts on daily life, like GPS that suggests alternate routes, Netflix and Spotify recommendations, and autocorrect capabilities. Generative AI promises to offer similar transformative benefits to its users. It is providing value to its users primarily by shortening time intensive processes.

Think of the first time you ordered a rideshare on your phone (after being used to hailing cabs), the first time you rented a home share (compared to cramped hotel rooms), even the first time you assembled a full set of living room furniture from flat pack boxes. Some experts call these “aha moments”. The “aha moment” of generative AI is the first time it saves a user a significant amount of time. Early ChatGPT “aha moments” have been seen in content creation, administrative tasks, marketing, rapid prototyping, and data analysis.

Some examples:

- Misha, an expert writer, feels stuck on his latest story – he uses generative AI to create multiple possible storylines for him to iterate on.

- Jen, a new accountant, needs to compile all her company’s tasks in one place – she uses generative AI to upload her documents and it succinctly groups them together.

- Sarah, a seasoned marketer, is hitting a wall with her email open rates – she uses generative AI to produce a list of dozens of subject lines to test.

- Jeff, a fresh developer, wants to impress his boss by coming up with multiple solutions to the problem – he uses generative AI to source all the ways he can code the solution.

- Jessica, a skilled office administrator, is looking for ways to improve the sales team’s efficiency – she uses generative AI to find similarities in sales scripts to test and analyze.

In all these cases, the “aha moment” is the remarkably reduced time from what was once an onerous and manual process. It is important to note that generative AI, like humans, will likely not produce 100% accurate results every single time (people that have played around with ChatGPT may recall incidences where the answers didn’t feel quite perfect), but the amount of time saved by getting directionally closer to an answer allows people to focus on the higher value work they deliver.

What are the best use cases of generative AI for investment managers?

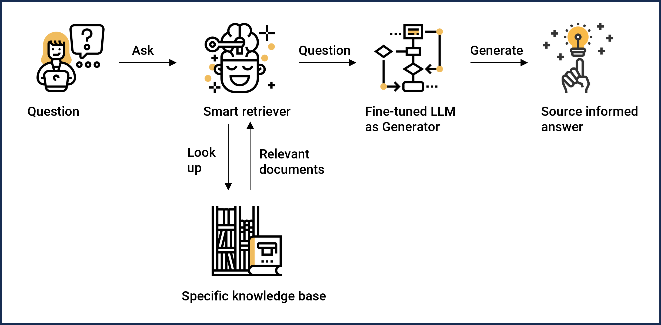

Artificial intelligence has access to all human knowledge with very good recall. It is also a tireless worker. All of this, combined with the time reduction in manual tasks, leads to generative AI’s best use cases being in task automation via LLM agents. LLM agents are also sometimes called Smart Retrievers and work by accessing a user’s specific data and current information.

For these agents to provide consistently good answers, however, is a lot of work. Creating smart LLM agents that can use specific knowledge bases is critical.

For example, within finance, if the goal was to create an LLM agent that did portfolio optimization, it would need to be able to correctly:

- Get the contents of your portfolio, understanding the identifiers (symbol, ISIN, etc.) and weights

- Get pricing and factor data for each of those securities

- Get the constraints of your optimization (i.e. max position sizes, etc.)

- Understand which optimization methodology you want to use

- Correctly format the optimization problem and execute external code to run the optimization

- Evaluate and analyze the results

Investment management task automation

Some of the highest-level ways that investment managers can use generative AI to their benefit are in automating their daily tasks. Think of how having an LLM agent that reads the news, an LLM agent that can read analyst reports, an LLM agent that will read earnings reports – all of which surface relevant, specific and customizable information to the asset manager, would save countless hours in the research process.

Generative AI can go a step further too, assisting portfolio managers with their idea generation and monitoring tasks. Some of the things generative AI can assist with:

- Ensure compliance with ESG policies

- Create and describe investing process tasks

- Ensure dividend growth

- Check news for dividend sentiment

- Check analyst reports for dividend sentiment

- Check financial statements for historic dividend growth

- Ensure cash flow growth

- Ensure positive news / analyst sentiment, etc.

- Check for special situations

- Debt covenants

- Warrant expiries

- Insider transactions

- Major Index inclusion check – is this stock in / eligible for / out of major indices

- Ensure dividend growth

Properly trained, an LLM agent could also assist an investment manager in doing scenario analysis like asking “which companies will be hurt the most by an increase in interest rates?” or “which companies will gain the most if oil goes to $80 per barrel?”.

Who will be the early winners in the generative AI space?

Early winners will emerge – we like to say that AI won’t replace your job, but you might be replaced by someone that is using AI if you’re not.

Early Adopters:

Firms that adopt the technology early will generate an efficiency lead over their competitors that will become difficult to surpass.

Cloud Computing:

Generative AI models need incredible processing power and to get quick responses it is mandatory that solutions are cloud based. This will lead to even wider usage of cloud and models are very computationally heavy.

Hardware Manufacturers:

There will be a race to create computer chips – there are already huge increases in orders at manufacturers like Nvidia (NVDA) and Advanced Micro Devices, Inc. (AMD) as people gear up to deploy generative solutions.

Software Companies:

Those that make generative AI a core part of their product offering will be huge winners. Software may eat the world – it will become mandatory to have specific software that makes you super productive.

Robotics:

Advancements in AI will make robot control much easier and there will be a large push to put the AI into robots to automate physical jobs. This should lead to an “OpenAI” moment in robotics in the next few years.

How can investment managers get ahead of generative AI?

Managers should actively be looking to incorporate generative AI into their process today. A buy, not build, mentality will allow asset managers to act quickly by leveraging the work already completed on generative AI – the earlier adopters will continue to amass efficiency gains that put them ahead of their competition, so acting quickly is of the utmost importance. A buy not build approach also allows companies to develop multiple agile tests of gen AI use cases at once to see where they want to invest additional resources.

Given how generative AI operates in a cloud environment, some asset managers will have security concerns. Although fears of data leaks are justified – no one wants their “secret sauce” to go public – the advanced security protocols of cloud providers make these fears extremely unlikely. Still, some investment management firms will demand private cloud solutions, where generative AI can be trained on their data and live entirely within their infrastructure. These strategies will be more cost intensive but provide the ultimate peace of mind for teams that want to seize the opportunity of generative AI that understands their investment ethos. It is important to underscore, however, the extremely secure environment cloud computing already operates within – teams that prefer to not expend additional costs can feel perfectly safe with their company data.

Expectation setting is also important – generative AI, and indeed artificial intelligence overall, is not a magic bullet. Some managers may expect a perfect hit rate, but the output from generative AI (just like humans) will never be “perfect”. The benefit of incorporating generative AI is where it gives answers that are largely correct, saving time and allowing an investment manager to spend more time on higher level decision making that can drive success. It is critical to remember the main benefits of incorporating generative AI – speed, efficiency, and that teams using it are better overall than teams that are not. It’s worth reiterating that Harvard Business Review study here: participants in the study using generative AI produced “significantly higher quality results (more than 40% higher quality compared to a control group).” Generative AI, like the humans that evaluate it, will not be perfect, but it will enhance the output of those using it.

Takeaways

Generative AI will continue to make life easier for its users by allowing them to do more with less and increase their efficacy. Within investment management, task automation will be the main way people will see benefits. Some early use cases for task automations within asset management are reading and summarizing unstructured data like news, analyst reports, earnings reports and summaries, and isolating relevant data faster and more efficiently than doing it manually. The best way investors can take advantage of this technology is to seek out immediate solutions, favouring a “buy, not build” model, as they test out multiple options to find what works best for their needs. Finally, private cloud versions of LLMs may be most beneficial for larger organizations that have the utmost need for keeping their data within their own internal data structures. Productivity growth across different teams within capital markets will mean that people can test more theses, run more scenarios, read more news, and improve their overall work output.

Nick Abe, COO and Co-Founder

na@boosted.ai

Investing in Artificial Intelligence with ARTI ETF

Interested in using generative AI to identify the best artificial intelligence and artificial intelligence-related companies fundamentally changing our world today?

Evolve Artificial Intelligence Fund (ARTI) is Canada’s first Artificial Intelligence Fund that uses generative AI in portfolio construction. Now trading. The Evolve Artificial Intelligence Fund is designed to provide investors with exposure to global securities from AI companies deemed to benefit from the increased global adoption of AI.

For more information on the Evolve Artificial Intelligence Fund or any of Evolve ETF’s lineup of exchange-traded funds, please visit our website or contact info@evolveetfs.com.

References:

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4573321#

- https://towardsdatascience.com/the-carbon-footprint-of-gpt-4-d6c676eb21ae

- https://www.freeingenergy.com/what-is-a-megawatt-hour-of-electricity-and-what-can-you-do-with-it/

- https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-AI-the-next-productivity-frontier#key-insights

Header Image Source: Getty Images Credit: cherdchai chawienghong