What a Boring Month!

On December 31st Bitcoin ended the day at USD $42,507. If you fell asleep and checked again a month later, it was still USD $42,458. Unchanged! So, you missed a boring month, right? Where is Bitcoin’s famous volatility, you might ask? Well, zoom in.

January was ETF approval month! US ETF issuers finally got the greenlight from the SEC to do what we’ve been doing in Canada for three years: launch spot Bitcoin in an ETF. The race for approval has captivated both traditional investors and the crypto community since Blackrock filed for a spot ETF last summer. Since then, it has been the obsessive focus of ETF analysts, most notably Eric Balchunas (@EricBalchunas on X) and James Seyffart (@JSeyff on X) who provided blow-by-blow coverage of every S1 update. Credit to them for calling the approval date and helping everyone follow along with accurate information.

When the approval did arrive, it was hardly an orderly affair. On January 9th the SEC’s official X account announced the approval, but then quickly said no they hadn’t, and claimed their account had been hacked. X supported this claim the next day with the story being that they had turned off 2 factor authentication and someone had guessed their password. It makes you wonder what it might have been? “21million” maybe? Or “GaryIsSatoshi”? Either way, the price of Bitcoin spiked on the tweet to USD $47,900, only to quickly fall back to $45,427 when they clarified that it wasn’t happening, yet.

Then the next day the SEC actually did decide to approve the ETFs but apparently posted some approval documents to their website before making the formal announcement. Further volatility followed, this time to the upside.

The first day of ETF trading, January 11th, saw the price break through USD $49,000 only to then fall back and close just above USD $46,000. This kicked off the rest of the month watching flows and trying to figure out whether you won or lost the “is it priced in?” debate.

Bitcoin did what Bitcoin does, with it closing the first day of US ETF trading largely unchanged, and as mentioned earlier, closing the first month of US ETFs almost unchanged to the penny. Both the “priced in” and “not priced in” crowds were left sorely disappointed while both did indeed have times when they were smug. Let this be a lesson to all of us who thought we knew what was going to happen.

Lots of intra-day and intra-month volatility should be a great reminder to investors that if you’re holding Bitcoin as a long-term strategic asset (as we would recommend), then you need to zoom out and not tie your emotions to the hourly or daily moves. The digital gold, store-of-value investment thesis for Bitcoin is a long-term argument, by definition. That being said, if you have laser eyes, then these moves can provide excellent entry points for adding to your stack.

ETF Flows

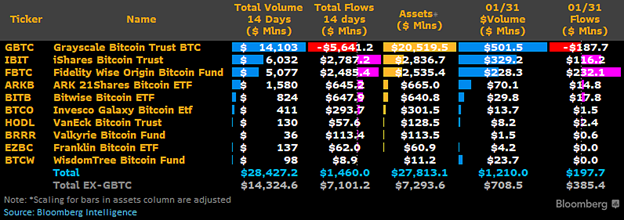

So after approvals, the next question on everyone’s mind was: flows. A lot of great analysis by Bloomberg was provided on X so that everyone could follow along, and this is where it got…complicated.

As you can see from the chart, up to (but not including January 31st), US spot Bitcoin ETFs did an aggregate of USD $28B in volume (trading on the stock exchange), however, only gathered USD $1.4B in net flow. This is because gross subscriptions excluding GBTC was USD $7.1B, but GBTC had USD $5.6B in redemptions.

As a bit of background, the Grayscale Bitcoin Trust (GBTC) was established in September 2013 as an OTC traded closed-end fund in the US. Over time, up to January 10th, it had grown to approximately USD $27B. Being a closed-end fund, there was no ability for investors to redeem, and for the past three years, since the launch of physical Bitcoin ETFs in Canada, it had traded at a discount to NAV. GBTC converted to an ETF on January 10th on the same day that the other nine ETFs launched in the US, so from the first minute of trading it was, and remains, the world’s largest Bitcoin ETF. The challenge, though, is that there are cohort of investors in GBTC who have wanted to redeem for years and finally have the ability to do so. As such, in the first two weeks we saw continually, daily, redemptions from the giant fund. This explains the small net flow figure, and caused some to say the ETF launch was a failure while nothing could be further from the truth. Make no mistake: the launch of Bitcoin ETFs in the US is, on every metric, the biggest ETF category launch in history. The fact that the “other nine” were able to outgrow the shrinking of GBTC is nothing short of remarkable. Surely some of the GBTC redemptions made a round-trip right back into one of the competing ETFs, which makes it all the harder to figure out how much of the flow is natural demand. Time, of course, will tell so it pays to sit back and watch the monthly flow numbers as the broader market starts to adopt Bitcoin as an investment asset through these new funds.

Supply and Demand

So, where does this leave us? One way to think about the market right now is to consider supply and demand. As we know, new supply of Bitcoin is created through the block-reward, currently at 6.25 BTC per new block and due to drop at the “halving” on April 21st. For the sake of this exercise let’s assume that GBTC’s remaining $20B of Bitcoin is also on the supply side while long time unitholders redeem to take profits or to move to other ETFs. That sets the market up something like this:

| Supply | Demand |

| Bitcoin Mining

6.25 BTC per new block ~11,588 BTC until the Halving

After April 21st, the block reward will drop to 3.125 BTC per new block. |

Bitcoiners

Hodlers who have a history of buying and not selling. 70% of total supply is in wallets that have not sold in >1 year ~13.7 million BTC These Bitcoiners have lived through at least one bear market. They are the “diamond hands”, and they’re still buying. (Source: Glassnode.com) |

| GBTC

~487,024 BTC (as at Jan 31, 2024, source: Grayscale.com)

Not all GBTC holders will sell. Many have a very low cost base and won’t want to trigger tax, so they’ll be quite happy staying the course in GBTC. But they’re currently seeing redemptions and it’s hard to know the commitment of those who are holding units. GBTC is likely to remain the biggest spot Bitcoin ETF for a while, but at the margins, we think it will shrink, and therefore is best viewed on the “supply” side of the market for the time being.

That being said, GBTC redemptions were slowing towards the end of the month, so it could retain most of its assets for a very long time. We’ll keep an eye on things and potentially move it out of the supply column as time goes by. |

The “other nine” US Bitcoin ETFs from Blackrock, Fidelity, Ark, Bitwise, Invesco, VanEck, Valkyrie, Franklin and Wisdom Tree. |

| Canadian Bitcoin ETFs. Notably, Evolve’s Bitcoin ETF ticker EBIT and EBIT.U | |

| Corporations holding Bitcoin on their balance sheet. Most famously Michael Saylor’s MicroStrategy now owns ~14,620 BTC. | |

| New Adoption

Adoption is growing worldwide as Layer 2 solutions like Lightning and Liquid mature and as nations move to provide regulatory clarity. Bitcoin is a movement as well as a technology, and global debasement of fiat currencies with the consequent inflation is alerting people that they need to look for a long-term store of value. Luckily Bitcoin is ready to welcome them regardless of the price. With an infinitely divisible, hard asset, there is enough for everyone. |

Over the past two weeks, we have seen that even in the early days, the demand side of US Bitcoin ETFs have outgrown redemptions from GBTC to the tune of USD $1.46B. So, let’s do some rough math. At a price of USD $42,458 per Bitcoin, approximately 34,386 BTC has been absorbed by US spot Bitcoin ETFs over the first 14 days. The Bitcoin network mines a new block roughly every ten minutes; therefore, 14 days x 24 hours x 6 blocks per hour = 2,016 BTC mined over the same period. This means US spot Bitcoin ETFs have on a net basis absorbed 17 times newly mined Bitcoin supply. What does this all mean? It means there’s new marginal demand in the market. And, in our humble opinion, it is just getting started.

We wish you all the very best for February and would like to remind you that, as a leap year, we get 144 more blocks this month. Enjoy every last one of them.

Evolve’s Bitcoin ETF (EBIT ETF) is one of Canada’s first bitcoin ETFs and provides investors with a simple and efficient way to access the price of physical Bitcoin through a secure investment solution. For more information on this fund, visit evolveetfs.com/ebit/.