Disney’s iconic empire faces challenges amid changing consumer behaviour and industry dynamics.

In Q3 reporting, Disney showed continued mixed results against low expectations and was significantly down from last year’s highs. However, there may be signs that Disney CEO Bob Iger’s plan to restructure and refocus the House of Mouse is working.¹

The company’s quarterly earnings report sheds light on its strategies for growth and transformation and offers a plan for the next half-decade that could see Disney right the ship and return to prosperity.

Parks, Cruises, and Streaming as Strategies for Growth

During the company’s recent earnings call, Iger underscored the significance of Disney’s theme parks and resorts, film studios, and streaming services to drive growth and value creation over the next five years.²

In their most recent earnings call, Disney reported theme park and cruise revenue was up 13% to $8.3 billion, with lower Walt Disney World in Florida attendance offset by growing attendance at Walt Disney theme parks in Shanghai and Hong Kong. And according to data from the most recent earnings report, upcoming Disney cruises are also 98% booked.³

The pivot towards the company’s theme parks and experiences division is a recognition on the part of Disney that these elements of its business are a unique offering in a world inundated with content.

And despite being a longstanding Disney attraction, there remains room to innovate in the theme park and resort space. Analysts have suggested unconventional ways of monetizing Disney’s cherished franchises like exclusive NFTs, metaverse tie-ins, and Apple’s Vision Pro headset that could offer novel avenues for enhancing guest experiences and revenue streams within the parks. Such innovations have the potential to redefine the theme park experience and attract a new visitor base.⁴

On the same earnings call, however, Iger conceded that Disney’s lack of a summer hit at the movies was “disappointing.” After all, it was the acquisition first of Pixar and, later, Marvel Studios that was instrumental in quintupling Disney’s market capitalization. Those studios yielded an almost unprecedented run of box office hits. But the movie-going landscape has changed post-pandemic, and Disney needs to recalibrate.

To that end, Disney’s film studios will focus on the allure of its iconic brands and franchises and aim to harness its beloved IP to roll out TV spinoffs, merchandise, and movie-tie in rides at its theme parks.⁵

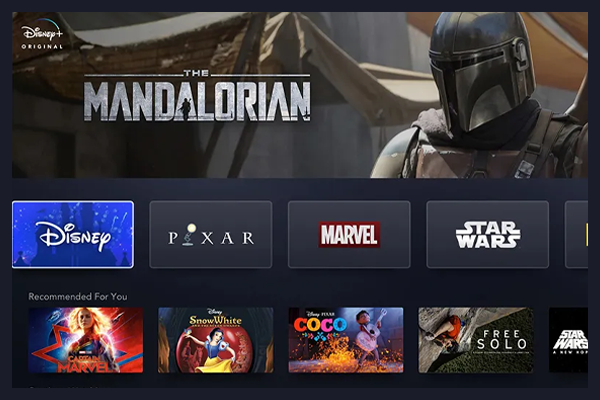

At the same time, with direct-to-consumer revenues, including Disney+, ESPN+, and Hulu, increasing by 9%, Disney will look for ways to get more from those revenue streams.

While the allure of the streaming sector is undeniable, achieving profitability remains a formidable task. The growth seen in streaming was primarily due to price hikes. So, Disney is bumping up the monthly price of Disney+ and Hulu without commercials while expanding its ad-supported tiers into select markets in Europe and in Canada beginning November 1, to strike a balance between scaling subscriber bases and maintaining profitability.⁶

Disney TV Assets Hurt by Cord-Cutting

One area where Disney may shrink its presence to focus on more revenue-positive areas at the core of its business is its linear television offerings. It’s a strategic move that may make sense. Linear network revenues experienced a 7% decline to $6.7 billion in the most recent quarter, with operating income down 23% to $1.9 billion.7 And as recently as July, Iger said that Disney’s TV assets ABC, FX, and National Geographic “may not be core” to the business.8

However, this shift is not without its challenges. While shedding non-growth TV networks could provide cash and resources, it’s uncertain whether the networks will yield the desired profits, given their role in generating up to a third of Disney’s revenue.9

Separating these networks from the company also presents other hurdles, as content-sharing relationships between networks, Hulu, and Disney+ could be disrupted. Likewise, ABC and ESPN benefit from joint negotiations for sports rights and ad sales. And with ESPN, Disney is also exploring strategic partnerships to propel the transition of the sports network to a direct-to-consumer (DTC) model to address a seismic shift in consumer behavior, with viewers increasingly expecting tailored content on demand.10

In potentially divesting itself of TV assets, Disney will need to ensure that even if it sells the networks, it can maintain that source of content for its streaming platforms and safeguard its revenue streams.

Disney’s Bold Bet on Sports Gambling

One new revenue stream—an expected one for the family-friendly Disney brand—is ESPN’s $2 billion sports betting collaboration with PENN Entertainment. ESPN and PENN Entertainment, a gaming company, will co-launch a sportsbook called ESPN Bet.11 This will mark ESPN’s transformation from merely covering sports to actively promoting sports-related gambling.

The partnership is a strategic response to the growing popularity of sports betting in the U.S. and a way for ESPN to ensure a new revenue stream. Cord-cutting has led to a decline in ESPN’s household reach, and rising sports rights costs, dwindling viewership, and the emergence of streaming giants like Apple and Amazon (who are also moving into sports coverage) have forced media companies, including ESPN, to explore new avenues for growth.

Beyond financial gains, the deal with PENN Entertainment aims to attract younger audiences and enhance brand loyalty. The launch of ESPN Bet is expected to amplify the network’s coverage of sports betting. New shows, online content, and in-broadcast odds graphics are on the horizon.

While this strategic move is poised to capitalize on the rising demand for betting-related content, ESPN faces potential reputational risks, particularly around problem gambling. Despite these challenges, however, ESPN’s foray into sports betting and strategic partnerships reflects the need for traditional media companies to remain relevant in the digital age. 12

Disney’s earnings report clearly reveals a company in transition, working to adapt to industry shifts while upholding its legacy. A renewed focus on parks and resorts, movies, and streaming, as well as new revenue sources from strategic partnerships and sports betting, will be key to the next act of Disney’s story.

Investing in Leadership: LEAD ETF

Looking for a way to access the leading companies of today, and the future companies of tomorrow?

The Evolve Future Leadership Fund (LEAD ETF) invests in a diversified portfolio of leading global companies across various sectors where clear trends are driving future growth. LEAD focuses on companies in four categories of leadership: Finance, Healthcare, Technology, and Media & Entertainment. This actively managed ETF has the added value of a covered call strategy applied on up to 33% of the portfolio, where the covered call options have the potential to provide extra income and help hedge long stock positions.

Four categories. One ETF. It’s time to take the LEAD.

For more information about the Evolve Future Leadership Fund (LEAD ETF) or any of Evolve ETF’s lineup of exchange-traded funds, please visit our website or contact us.

Sources

- Marks, J., “Disney’s quarter wasn’t clean, but we see evidence that CEO Bob Iger’s turnaround plan is working,” CNBC, August 9, 2023; https://www.cnbc.com/2023/08/09/disney-quarter-wasnt-clean-but-we-see-evidence-ceo-bob-igers-plan-is-working.html

- Whitten, S., “Disney posts mixed results for quarter plagued by streaming woes, restructuring costs,” CNBC, August 9, 2023; https://www.cnbc.com/2023/08/09/disney-dis-earnings-report-q3-2023.html

- Blair, E., “Six takeaways from Disney’s quarterly earnings call,” NPR, August 9, 2023; https://www.npr.org/2023/08/09/1192746089/disney-earnings-call

- Moses, L., “How Bob Iger’s big plan to shrink Disney could pay off and how it could backfire, according to industry insiders,” Business Insider, August 22, 2023; https://www.businessinsider.com/bob-iger-plan-smaller-disney-could-work-potential-pitfalls-2023-8

- Blair, E., “Six takeaways from Disney’s quarterly earnings call,” NPR, August 9, 2023; https://www.npr.org/2023/08/09/1192746089/disney-earnings-call

- Sherman, A., “Disney to raise price on ad-free Disney+ to $13.99 per month starting October 12,” CNBC, August 9, 2023; https://www.cnbc.com/2023/08/09/disney-to-raise-disney-price-for-ad-free-plan-in-september.html

- Blair, E., “Six takeaways from Disney’s quarterly earnings call,” NPR, August 9, 2023; https://www.npr.org/2023/08/09/1192746089/disney-earnings-call

- Rizzo, L. & Sherman, A., “Disney could soon sell its TV assets as Iger says business ‘may not be core’ to the company,” CNBC, July 13, 2023; https://www.cnbc.com/2023/07/13/disney-ceo-iger-opens-door-to-unloading-tv-assets.html

- “The Walt Disney Company Reports Third Quarter And Nine Months Earnings For Fiscal 2023,” Walt Disney Company, August 9, 2023; https://thewaltdisneycompany.com/app/uploads/2023/08/q3-fy23-earnings.pdf

- Sherman, A., “ESPN held talks with NBA, NFL and MLB in search for strategic partner, sources say,” CNBC, July 21, 2023; https://www.cnbc.com/2023/07/21/espn-had-talks-with-nba-nfl-in-search-for-strategic-partner.html

- Sayre, K., “ESPN Strikes $2 Billion Sports-Betting Deal with Penn Entertainment,” The Wall Street Journal, August 8, 2023; https://www.wsj.com/articles/espn-penn-entertainment-sports-betting-deal-ac02b9a6

- Dart, T., “Disney and ESPN bet big on entering gambling arena – but will they win?,” The Guardian, August 19, 2023; https://www.theguardian.com/sport/2023/aug/19/disney-espn-sports-betting-deal