FANGMA is an acronym that represents some of the most important companies in big tech today. Standing for Facebook, Apple, Netflix, Google, Microsoft, and Amazon, odds are you use one (or more) of the advanced technologies or popular consumer services these six companies are responsible for—as do billions of other people each day.

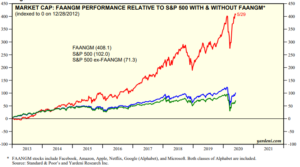

For investors, it would be difficult to talk about today’s stock market without dealing in some way with one or more of these tech giants. FANGMA stocks are responsible for a significant portion of market gains and economic growth over the past decade. Currently, the combined market cap of these six stocks is approximately $7.7 trillion, making up roughly 20% of the S&P 500 and 40% of the Nasdaq 100.

Here’s what you need to know about FANGMA stocks for your portfolio.

How these tech giants impact everyday life

It is hard to over-estimate the impact that these six companies have on the day-to-day life of how billions of people work, play, shop, and interact. This is all the more remarkable given the diversity of business models of each FANGMA stock.

Facebook is the world’s preeminent social networking platform. Roughly 30% of the world’s population—more than 2.5 billion people—interact on Facebook. The company monetizes this user base via targeted ads based on users’ personal preferences and usage patterns.

Apple designs, manufactures, and sells smartphones, personal computers, tablets, wearables and accessories. Apple products like the iPhone, the iPad, and the Apple Watch have revolutionized personal computing and communications over the last 20 years. Amongst Apple’s fast-growing revenue sources are its services business, including its iCloud cloud service and streaming offerings Apple Music and Apple TV+.

Netflix is an online entertainment streaming service specializing in movies and television shows. Known for impressive customer growth, Netflix’s subscriber base has grown from 22 million in 2011 to more than 190 million in 2020. Netflix has also become a leading producer of its own exclusive content in the face of rival streaming services, moving away from its earlier incarnation as primarily a content aggregator.

Alphabet is the parent of various businesses that have grown out of a dominant position in internet search. The Google search engine receives an average of over 60,000 search requests every second of every day. Other apps like YouTube, Google Docs, and Google Maps have likewise come to dominate their respective spaces. These businesses have been highly profitable thanks to targeted online advertising sales. In addition, Alphabet’s mobile operating system, Android, now holds an estimated 75% share of the global smartphone market.

Microsoft is one of the world’s biggest tech companies, selling personal computing devices, cloud systems and services, software, and other products to both consumers and businesses. They compete in a broad range of industries against Apple, Amazon, IBM, and Oracle. In recent years, Microsoft’s Intelligent Cloud has been its fastest-growing segment and most significant source of profit.

Amazon is one of the world’s leading business-to-consumer e-commerce platforms. Initially making the name with book sales, the company is now widely billed as “the everything store,” selling a vast array of products to over 300 million active customers in the U.S. alone. Half of those customers also subscribe to its paid membership service, Amazon Prime. Amazon has further leveraged its expertise in cloud computing and data analytics by developing Amazon Web Services, an on-demand cloud computing platform for individuals, companies, and governments.

Source: Medium

The benefits of FANGMA for your portfolio

Given the share of the stock market made up of FANGMA stocks, as well as the core business, commerce, computing, and entertainment services they offer on a global scale, the desirability of holding FANGMA stocks in your portfolio should be apparent. While nothing is a guarantee, FANGMA stocks have historically outperformed the S&P 500 Index. And FANGMA stocks benefit from competitive advantages that make them attractive investments.

For example, most of the FANGMA companies benefit from the network effect—their goods and services become more valuable the more people use them. Facebook and Google can rely on their billions of active users to grow value for their services. The Amazon Prime subscription service brings tens of millions of shoppers to the Amazon site every day, making it highly attractive to third-party merchants.

Intangible assets like big data likewise give FANGMA companies advantages to profitability not enjoyed by other businesses. Facebook, Amazon, and Google leverage vast stores of customer data to sell targeted advertising. Netflix’s insight into tens of millions of subscribers’ viewing preferences provides invaluable guidance on what original content to produce and what exclusive licenses to secure. Apple is almost unique in making both the hardware and software for its devices and it is the only company doing so at scale.

These competitive advantages can make the FANGMA stocks great potential investments. A first-of-its-kind product, the Evolve FANGMA Index ETF provides investors with exposure to the equity securities of six Big Tech titans: Alphabet Inc., Amazon Inc., Apple Inc., Facebook Inc., Netflix Inc. and Microsoft Corp in a single, easy-to-use investment vehicle.

FANGMA is an acronym that represents some of the most important companies in big tech today. Standing for Facebook, Apple, Netflix, Google, Microsoft, and Amazon, odds are you use one (or more) of the advanced technologies or popular consumer services these six companies are responsible for—as do billions of other people each day.

For investors, it would be difficult to talk about today’s stock market without dealing in some way with one or more of these tech giants. FANGMA stocks are responsible for a significant portion of market gains and economic growth over the past decade. Currently, the combined market cap of these six stocks is approximately $7.7 trillion, making up roughly 20% of the S&P 500 and 40% of the Nasdaq 100.

How these tech giants impact everyday life

It is hard to over-estimate the impact that these six companies have on the day-to-day life of how billions of people work, play, shop, and interact. This is all the more remarkable given the diversity of business models of each FANGMA stock.

Facebook is the world’s preeminent social networking platform. Roughly 30% of the world’s population—more than 2.5 billion people—interact on Facebook. The company monetizes this user base via targeted ads based on users’ personal preferences and usage patterns.

Apple designs, manufactures and sells smartphones, personal computers, tablets, wearables and accessories. Apple products like the iPhone, the iPad, and the Apple Watch have revolutionized personal computing and communications over the last 20 years. Among Apple’s fast-growing revenue sources are its services business, including its iCloud cloud service and streaming offerings Apple Music and Apple TV+.

Netflix is an online entertainment streaming service specializing in movies and television shows. Known for impressive customer growth, Netflix’s subscriber base has grown from 22 million in 2011 to more than 190 million in 2020. Netflix has also become a leading producer of its own exclusive content in the face of rival streaming services, moving away from its earlier incarnation as primarily a content aggregator.

Alphabet is the parent of various businesses that have grown out of a dominant position in internet search. The Google search engine receives an average of over 60,000 search requests every second of every day. Other apps like YouTube, Google Docs, and Google Maps have likewise come to dominate their respective spaces. These businesses have been highly profitable thanks to targeted online advertising sales. In addition, Alphabet’s mobile operating system, Android, now holds an estimated 75% share of the global smartphone market.

Microsoft is one of the world’s biggest tech companies, selling personal computing devices, cloud systems and services, software, and other products to both consumers and businesses. They compete in a broad range of industries against Apple, Amazon, IBM, and Oracle. In recent years, Microsoft’s Intelligent Cloud has been its fastest-growing segment and most significant source of profit.

Amazon is one of the world’s leading business-to-consumer e-commerce platforms. Initially making the name with book sales, the company is now widely billed as “the everything store,” selling a vast array of products to over 300 million active customers in the U.S. alone. Half of those customers also subscribe to its paid membership service, Amazon Prime. Amazon has further leveraged its expertise in cloud computing and data analytics by developing Amazon Web Services, an on-demand cloud computing platform for individuals, companies, and governments.

The benefits of FANGMA for your portfolio

Given the share of the stock market made up of FANGMA stocks, as well as the core business, commerce, computing, and entertainment services they offer on a global scale, the desirability of holding FANGMA stocks in your portfolio should be apparent. While nothing is a guarantee, FANGMA stocks have historically outperformed the S&P 500 Index. And FANGMA stocks benefit from competitive advantages that make them attractive investments.

For example, most of the FANGMA companies benefit from the network effect—their goods and services become more valuable the more people use them. Facebook and Google can rely on their billions of active users to grow value for their services. The Amazon Prime subscription service brings tens of millions of shoppers to the Amazon site every day, making it highly attractive to third-party merchants.

Intangible assets like big data likewise give FANGMA companies advantages to profitability not enjoyed by other businesses. Facebook, Amazon, and Google leverage vast stores of customer data to sell targeted advertising. Netflix’s insight into tens of millions of subscribers’ viewing preferences provides invaluable guidance on what original content to produce and what exclusive licenses to secure. Apple is almost unique in making both the hardware and software for its devices and it is the only company doing so at scale.

These competitive advantages can make the FANGMA stocks great potential investments. A first-of-its-kind product, the Evolve FANGMA Index ETF provides investors with exposure to the equity securities of six Big Tech titans: Alphabet Inc., Amazon Inc., Apple Inc., Facebook Inc., Netflix Inc. and Microsoft Corp in a single, easy-to-use investment vehicle.